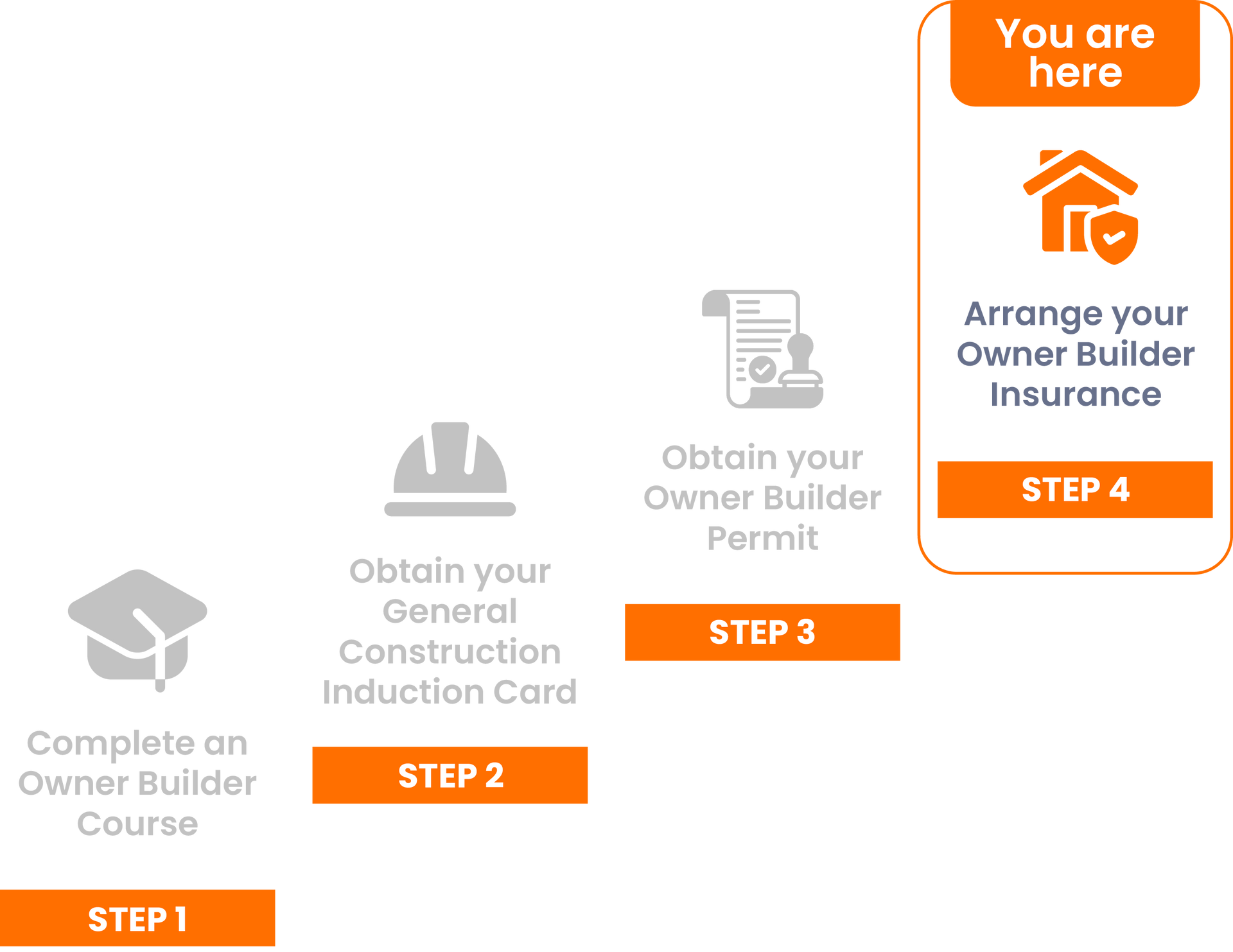

What is Owner Builder Insurance?

Owner Builder Insurance is a bundle of insurance policies that protect you, your site, and your workers during construction. It’s designed specifically for owner-builders managing their own residential build or renovation project.

Why is this Needed?

It’s legally and financially important. This insurance protects you from injuries, property damage, public liability, and other risks that may occur during the build. In many cases, your certifier, lender, or developer will require proof of insurance before you can proceed.

How it Works

1. Contact an insurance provider that offers Owner Builder cover.

2. Request a quote — you’ll need to provide:

- Your name and site address

- Anticipated site start and finish dates

- Estimated total project cost

- Your Owner Builder Permit number (if issued)

- A brief description of your project scope (e.g. new build, extension, renovation)

3. Choose the level of coverage you need:

- Public Liability (required for site safety and legal protection)

- Construction Works (recommended for damage, fire, theft, etc.)

- Optional: Voluntary Workers Cover, Tools Cover, Legal Liability

4. Review your quote and confirm the policy

5. Pay the premium to activate the cover

6. Receive your Certificate of Currency (PDF)

Keep your certificate on file — you may need to present it to:

- Your certifier or building surveyor

- Your bank or lender (for staged payments)

- A land developer (if building in a new estate)

Once Received

Once you've received your Certificate of Currency, upload it to the Document Library and then click the

orange “Mark Complete” button to move to the next step in your construction workflow.